Materiality and stakeholder dialogue

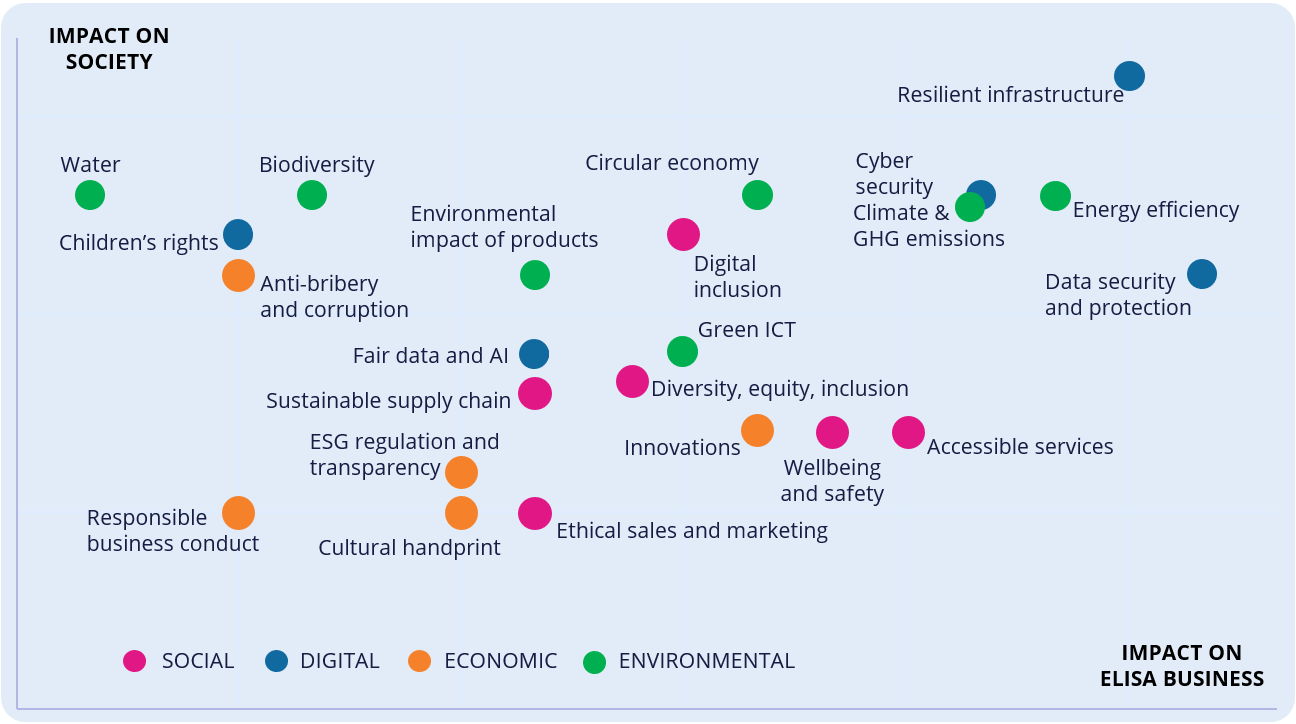

We have recognised the most important economic, social and environmental impacts of our operations, products and services, as well as other significant trends affecting the ICT-sector.

Materiality analysis is part of our continuous sustainability work. Business impacts of the material topics are evaluated in Corporate responsibility management board. Results are illustrated below:

Stakeholder dialogue

Our most important stakeholders are our personnel, customers, owners, social operators1) and partners.

In addition, we have a continuous dialogue regarding the needs of groups in a vulnerable position (for example children, young people and the elderly).

Stakeholders are reviewed annually in Corporate responsibility management board as a part of materiality assessment.

We collect insights about stakeholder expectations and relevant sustainability topics by means of regular meetings, surveys and conducting surveys as well as through daily management.

1) Social operators include the authorities, officials, politicians, NGOs and other organisations, as well as research organisations. External stakeholders are examined from the point of view of both customers and influences in society.

Elisa has significant memberships in the following organisations, among others:

- UN Global Compact Nordic Network

- Climate Leadership Coalition (CLC)

- Finnish Business and Society (FIBS)

- Joint Auditing Cooperation (JAC)

- Confederation of Finnish Industries (EK)

- Finland Chamber of Commerce / Finnish Chambers of Commerce

- Service Sector Employers’ Association (PALTA ry)

- Confederation of Telecommunications and Information Technology (FiCom ry)

- Finnish Information Society Development Centre (TIEKE ry)

- Finnish Quality Association ry

- Finnish Direct Marketing Association ry

- ICT Producer Co-operative (Elker ry)

- Finnish Packaging Recycling (RINKI Oy)

- Paristokierrätys - Producer organisation for portable batteries and accumulators (RecSer Oy)

- European Telecommunications Network Operators Association (ETNO)

- GSM Association

- Inklusiiv